If you’ve been injured at work, understanding your rights under the workers compensation payout guide in Victoria can feel overwhelming. Many injured Victorians want to know, “How much can I expect from a workers’ compensation payout?”

This guide explains exactly how workers’ compensation benefits are calculated, what types of payouts exist, and what you may be entitled to based on your injury, earnings, and circumstances.

It also clarifies how common law claims, lump sum payments, and weekly compensation payments work in practice.

If you’re dealing with a work-related injury, don’t leave your entitlements to chance. Seek legal advice early so you don’t miss compensation you may be entitled to.

To make things easier to follow, here’s a quick overview of what you’ll find in this guide.

Table of Contents

- What Is WorkCover?

- Who Is Eligible for Workers’ Compensation?

- Types of Workers’ Compensation Payouts

- Statutory vs. Common Law Claims: What’s the Difference?

- What Affects the Size of Your Workers’ Compensation Payout?

- Your WorkCover Claim Process: A Step-by-Step Guide

- Your WorkCover Journey: From Injury to Settlement

- Realistic Payout Examples (Approximate Only)

- How to Increase Your Chances of a Higher Payout

- Common Myths About WorkCover Payouts

- Employer Responsibilities Under WorkCover

- Common Law Claims: What You Need to Know

- Time Limits for Lodging WorkCover Claims

- How Our WorkCover Lawyers Maximise Your Compensation

- Get Help With Your Workers’ Compensation Payout

- FAQs

What Is WorkCover?

WorkCover is Victoria’s workers’ compensation scheme, administered by the Victorian WorkCover Authority, with claims handled by insurers such as Gallagher Bassett, EML, and Allianz. It provides financial support and medical treatment for injured Victorian workers, supporting both physical and psychological injuries.

Because it operates as a no-fault system, you do not need to prove employer negligence to receive initial workers’ compensation payments, such as:

- Weekly payments for lost income

- Medical treatment and rehabilitation

- Support services, including physio and surgery

- Impairment benefits for permanent injuries

This structure ensures you can access early treatment, attend hospital visits, and recover without worrying about lost income.

Who Is Eligible for Workers’ Compensation?

A workers’ compensation claim can be lodged by:

- Full-time, part-time, or casual employees

- Apprentices and trainees

- Deemed workers

- Subcontractors (in some circumstances)

You may lodge a claim for injuries sustained at work, including:

- Physical injuries (fractures, sprains, and musculoskeletal injuries)

- Psychological conditions (PTSD, depression, or work-related stress)

- Permanent injury conditions that develop over time (e.g., RSI)

- Aggravations of pre-existing injuries

A claim may also apply when the injury occurred off-site but is still connected to work.

Types of Workers’ Compensation Payouts

1. Weekly Payments

If you cannot work due to your injuries, you may receive weekly payments based on your pre-injury earnings or PIAWE.

- First 13 weeks: 95% of pre-injury earnings

- After 13 weeks: 80%

- Long-term claims may continue depending on ongoing capacity

Weekly payments are designed to provide financial support while you recover and attend necessary medical treatment.

2. Medical and Like Expenses

You may be eligible for reimbursement of:

- Medical bills

- Specialist consultations

- Medical costs such as medications

- Physiotherapy, surgery, and rehab

- Travel to appointments

- Aids, appliances, and equipment

These benefits cover all reasonable treatment expenses backed by medical evidence.

3. Lump Sum for Permanent Impairment

If you have a permanent impairment, you may claim a lump sum payout through an impairment benefit claim.

Eligibility:

- 10% whole person impairment (physical)

- 30% person impairment (psychiatric injury)

Your impairment must be assessed through a medical assessment by an independent medical examiner approved by WorkSafe.

The lump sum payment amount depends on your assessed whole person impairment percentage, with payments ranging from approximately $15,000 for minor impairments to a maximum of $759,510 for the most severe injuries (indexed annually). The exact amount is calculated using statutory tables based on your impairment rating.

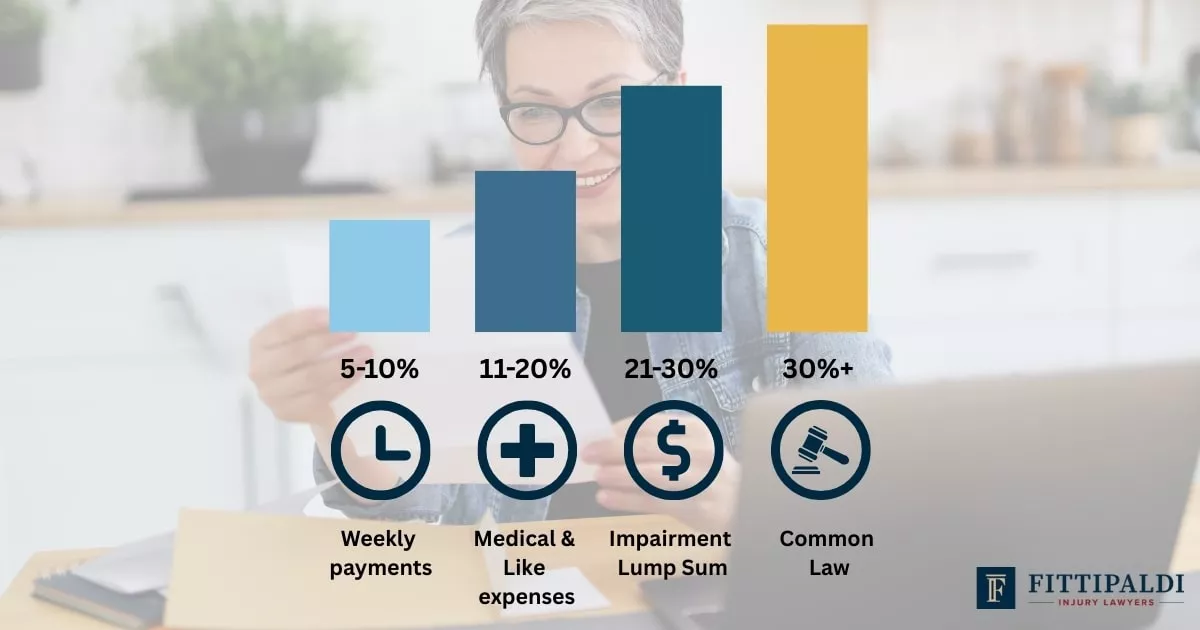

Example Impairment Payout Ranges (Victoria)

| Impairment Rating (WPI) | Approximate Payout Range |

| 5-10% | $15,000-$25,000 |

| 11-20% | $26,000-$60,000 |

| 21-30% | $61,000-$110,000 |

| Higher % | Up to $759,510 (max) |

Note: These figures change annually due to indexation.

4. Common Law Damages

You may make a common law claim if:

- You have a serious injury, supported by a serious injury certificate or injury certificate, and

- Your employer’s negligence contributed to your injuries.

These claims can include:

- Pain and suffering damages

- Past and future loss of earnings

- Future economic loss

A successful common law payout can exceed $1 million, depending on your individual circumstances, personal circumstances, and lost wages.

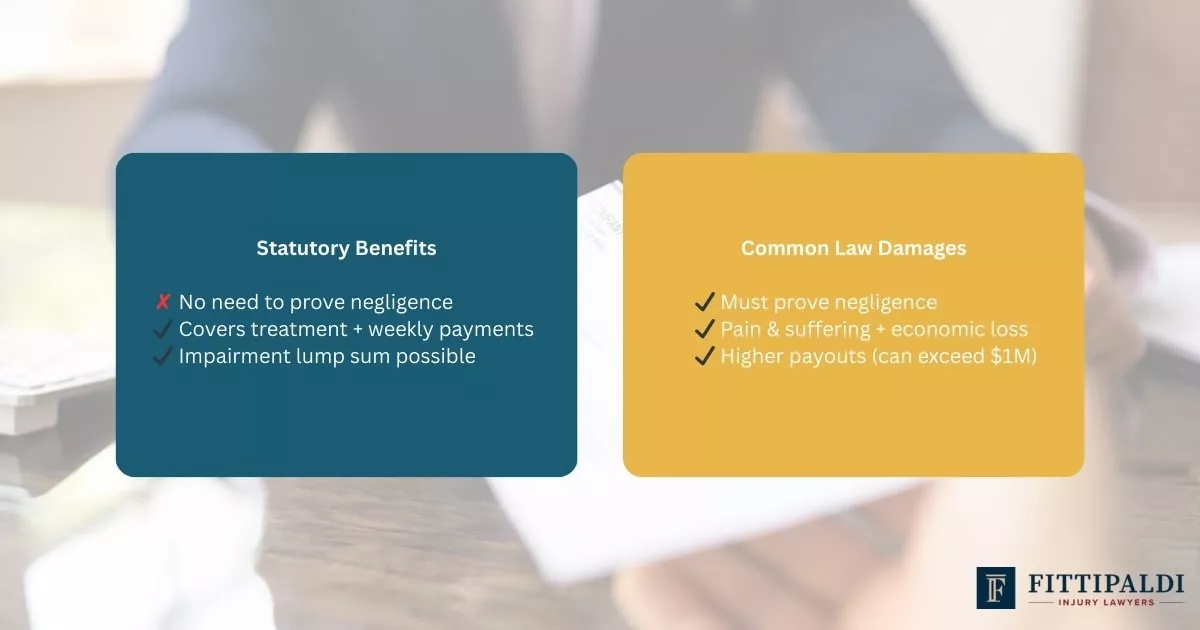

Statutory vs. Common Law Claims: What’s the Difference?

Many injured workers aren’t sure which type of claim applies to them. Here’s the difference at a glance:

Comparison Table

| Feature | Statutory Benefits | Common Law Damages |

| Do you need to prove negligence? | No | Yes |

| Covers medical expenses? | ✔ Yes | ✔ Yes (not the main focus) |

| Weekly payments? | ✔ Yes | ✘ No |

| Lump sum available? | ✔ Impairment benefit | ✔ Pain & suffering + economic loss |

| Typical payout range | $15,000–$759,510 | Can exceed $1 million |

| Process | Assessment-based | Legal/negotiation process |

Not sure which applies to your situation? Get a free claim assessment. Time limits apply.

What Affects the Size of Your Workers’ Compensation Payout?

The amount you receive can vary significantly. Some of the biggest factors include:

1. Severity of Your Injury

More serious injuries usually result in higher impairment ratings and larger payouts.

2. Whether Surgery Is Required

Surgical treatment often indicates long-term damage, influencing compensation levels.

3. Your Pre-Injury Earnings

Higher-income workers generally receive higher weekly payments.

4. Whether You Can Return to Work

If your ability to work is permanently reduced, your entitlement may be higher.

5. Long-Term Impact on Daily Living

Loss of independence, chronic pain, and psychological effects all influence payout assessments.

6. Whether Negligence Was Involved

Negligence opens the door to common law damages, which can be significantly higher than statutory benefits.

Your WorkCover Claim Process: A Step-by-Step Guide

1. Report Your Injury

You notify your employer, usually within 30 days.

2. Lodge Your WorkCover Claim

You submit the form and medical certificate. If the insurer doesn’t respond within 28 days, the claim is automatically accepted.

3. Your Capacity for Work Is Assessed

Doctors determine what work (if any) you can do.

4. Weekly Payments Are Calculated

Based on your PIAWE, including overtime and allowances.

5. Independent Medical Assessment

Your whole person impairment is assessed to determine lump sum eligibility.

6. Serious Injury Application (if needed)

Required before pursuing common law damages.

7. Negotiations or Court

Your lawyer negotiates with the insurer, or the claim may proceed to court.

-

Important Update for Long-Term Weekly Payments (March 2024):

For claims reaching 130 weeks on or after 31 March 2024, workers must meet two criteria to continue receiving weekly payments:

- No current work capacity (likely to continue indefinitely)

- Permanent whole person impairment of 21% or more

This represents a significant change to the workers’ compensation scheme. If you’re approaching the 130-week mark, seek legal advice early to understand how this affects your entitlements.

Your WorkCover Journey: From Injury to Settlement

A typical WorkCover claim often follows this path:

- The injury occurs (at work or because of work).

- You seek medical treatment and get a certificate of capacity.

- Your employer is notified, and the claim is lodged.

- WorkCover assesses your claim and begins payments if approved.

- Ongoing treatment and reviews take place as your recovery progresses.

- Impairment assessment occurs after your condition stabilises.

- Potential application for serious injury if negligence is involved.

- Negotiation or litigation leads to a settlement.

Understanding this journey helps reduce overwhelm and sets realistic expectations.

Realistic Payout Examples (Approximate Only)

Statutory Impairment Examples

- 15% WPI (back injury): ~$38,000

- 30% WPI (psychological injury): ~$100,000

Common Law Examples (Hypothetical)

| Injury Type | Scenario | Approx. Outcome |

| Back injury | Worker unable to return to heavy labour | $400k–$800k |

| Psychological injury | Long-term PTSD impacting career | $300k–$600k |

| Severe physical injury | Permanent disability with future income loss | $1M+ |

Want an estimate tailored to your situation? Get a free WorkCover payout check.

How to Increase Your Chances of a Higher Payout

Here are practical, legally safe ways to strengthen your claim:

- Report your injury early to avoid disputes.

- Attend all medical appointments and follow treatment plans.

- Document symptoms and limitations.

- Keep receipts and records for all expenses.

- Avoid posting about the injury on social media.

- Get legal advice before signing any document from WorkCover.

Doing these consistently helps ensure your claim reflects the true impact of your injury.

Common Myths About WorkCover Payouts

Myth 1: “My employer needs to approve my claim.”

False. Approval comes from the insurer, not your employer.

Myth 2: “If I claim WorkCover, I could lose my job.”

Retaliation is illegal in Victoria.

Myth 3: “Psychological conditions don’t count.”

They do! Though the impairment threshold is higher.

Myth 4: “A lawyer is only needed if I go to court.”

Most payouts happen without going to court, but having a lawyer can increase the final amount.

Employer Responsibilities Under WorkCover

Your employer must:

- Provide a safe and healthy workplace.

- Record and report injuries promptly.

- Cooperate with WorkCover investigations.

- Support your return-to-work plan.

- Avoid discriminatory or retaliatory actions.

If they fail to meet these responsibilities, it can impact your claim and your well-being.

Common Law Claims: What You Need to Know

To lodge a serious injury application, you must show significant long-term consequences of your injuries.

A serious injury certificate may be granted if:

- You have 30% psychiatric WPI, or

- Your physical injury satisfies the narrative test

If approved, you may make a common law claim for pain and suffering damages and future economic loss.

You can pursue a lump sum claim even if you have already received statutory benefits, although some payments may offset each other.

Time Limits for Lodging WorkCover Claims

- Report injury to employer: within 30 days

- Lodge WorkCover claim: within 30 days of becoming aware of injury

- Claim reimbursement for medical expenses: within 6 months of the service date

- Common law claims: within 6 years of injury

Missing time limits can affect your ability to receive further compensation.

If you’re unsure whether you’re still within time, speak to a lawyer as soon as possible.

How Our WorkCover Lawyers Maximise Your Compensation

Our team helps:

- Lodge your workers’ compensation claim

- Navigate insurer disputes

- Prepare medical authority forms

- Organise medical assessments

- Evaluate your impairment benefits

- Negotiate workers’ compensation settlement outcomes

- Pursue common law damages where appropriate

We represent injured workers from start to finish with transparent legal fees and free claim advice.

If you need guidance on your workers’ compensation payout, our specialist workers’ compensation lawyers are here to support you.

Get Help With Your Workers’ Compensation Payout

If you’ve suffered a work-related injury, your individual circumstances will determine the compensation you may receive.

Our team can help you understand your rights, protect your entitlements, and pursue a successful claim.

- Get clarity on your rights

- Understand your payout options

- Maximise your compensation under the Victorian system

Get your free WorkCover payout assessment; time limits apply.

FAQs

How much is a typical payout?

Impairment benefit payouts depend on your whole person impairment (WPI) rating:

- 5-10% WPI: Approximately $15,000-$25,000

- 11-20% WPI: Approximately $26,000-$60,000

- 21-30% WPI: Approximately $61,000-$110,000

- Higher percentages can reach the statutory maximum of $759,510 (indexed annually)

Common law damages have no statutory maximum and vary based on injury severity, negligence, and economic loss. Successful claims range significantly depending on individual circumstances.

Note: These are approximate ranges based on 2023/24 compensation tables. Exact amounts depend on specific WPI percentage, injury type, and date of injury. For precise figures, consult WorkSafe Victoria’s official compensation tables.

Can I receive both weekly payments and a lump sum?

Yes. These benefits apply under different categories within the workers’ compensation scheme.

What qualifies as a serious injury?

A serious injury can be:

- 30% psychiatric impairment

- Long-term physical injuries that limit daily activities

- A condition meeting the WorkSafe narrative test

What if my claim is rejected?

You can dispute it through conciliation or court proceedings. Legal assistance is strongly recommended.

How long does the process take?

- Weekly payments decision: Within 28 days of claim lodgement (deemed accepted if no decision made within this timeframe)

- Impairment benefits: Assessed once injuries have stabilized, typically at least 12 months after injury

- Common law claims: Variable timeframe – WorkSafe has 120 days to respond to serious injury application, followed by conference and settlement negotiations or court proceedings