Every year, over 40,000 Victorians file claims with the Transport Accident Commission (TAC) following motor vehicle accidents.

If you’re involved in a car accident in Melbourne, understanding your rights is essential to ensure you receive the support and compensation you deserve.

This guide unpacks Victoria’s unique no-fault system, explains your immediate protections, and walks you through the claims process—from medical coverage and property damage to legal representation and common law rights.

Whether you’re a driver, passenger, cyclist, or pedestrian, this article will equip you with the knowledge to confidently navigate the aftermath of a car accident and secure the best possible outcome for your recovery and compensation.

Table of Contents

- Immediate Rights and Entitlements Following a Melbourne Car Accident

- Understanding Victoria’s Transport Accident Commission (TAC) System

- What TAC Benefits Cover in Melbourne Accidents

- Your Rights Regarding Property Damage and Vehicle Repairs

- Common Law Rights for Pain and Suffering Compensation

- Legal Representation and No Win No Fee Options

- Special Circumstances and Additional Rights

- Time Limits and Important Deadlines for Melbourne Accident Claims

- Getting Help: Free Resources and Support Services

- Protecting Your Rights: Essential Action Steps

Immediate Rights and Entitlements Following a Melbourne Car Accident

Emergency Medical Treatment Regardless of Fault

The moment you’re involved in an accident on Melbourne roads, you have the right to emergency medical treatment—no questions asked.

Victorian law ensures anyone injured in a car accident receives immediate medical care through the Transport Accident Commission (TAC) scheme, regardless of fault, insurance, or vehicle registration.

Emergency services respond promptly to the accident scene, and ambulance transport to the hospital is covered at no cost.

This protection applies to all involved—drivers, passengers, pedestrians, and cyclists—ensuring your health and safety come first without financial barriers.

TAC Coverage Activation

Your TAC coverage kicks in automatically the moment you’re involved in a motor vehicle accident in Victoria.

It doesn’t matter if you have car insurance, who’s at fault, or even if you don’t own a vehicle.

The system is funded through compulsory third-party premiums, which are included in every Victorian vehicle registration fee, creating a safety net for everyone. These collected registration fees are used by the TAC to fund benefits and compensation for individuals injured in road accidents.

What’s excellent about Victoria’s system is how quickly support starts. Unlike traditional insurance, where fault can delay your benefits, TAC steps in right away.

This means you can focus on getting better without worrying about paperwork or insurance hassles.

Right to Legal Representation at No Upfront Cost

From the moment you’re involved in an accident, you have the clear right to seek legal advice and representation. Many Melbourne law firms that specialise in personal injury claims offer free initial consultations, so you can explore your options without feeling any financial pressure.

Most reputable personal injury lawyers also work on a no-win-no-fee basis, meaning you can get expert legal help without paying anything upfront.

And if you’re not happy with your current lawyer, you have the right to switch—because you deserve the best possible support to get the outcome you need.

Police Attendance and Documentation Rights

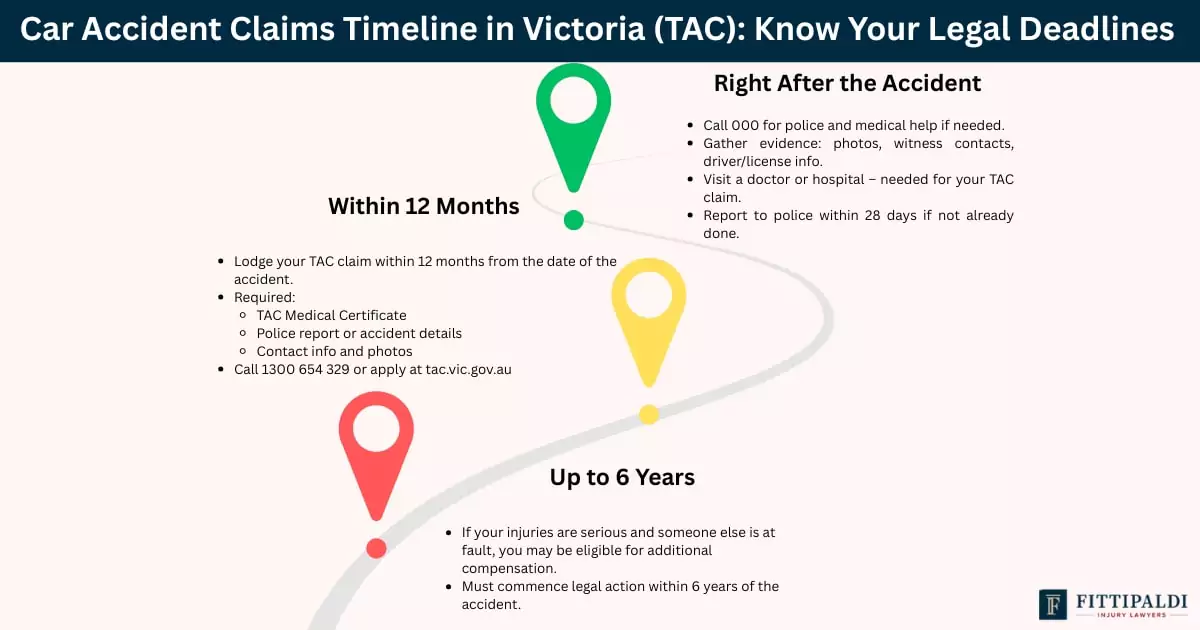

You have the right to have police come to the scene and officially document any significant accident. This isn’t just a formality—it’s a key step that protects you when it comes to insurance claims and any legal matters down the line.

The police officer who arrives will carefully record details about the accident, including witness statements, weather conditions, and other important factors. It is vital that the police attend the accident scene as soon as possible to preserve evidence.

It’s also important to know that you’re protected from being pressured into admitting fault right then and there.

While you do need to share basic information, such as your contact details and vehicle registration numbers, you don’t have to discuss who caused the accident or what led to it.

Collect the full names and addresses of the owners and drivers of each vehicle involved in the accident.

Understanding Victoria’s Transport Accident Commission (TAC) System

How TAC Operates as Victoria’s Insurer

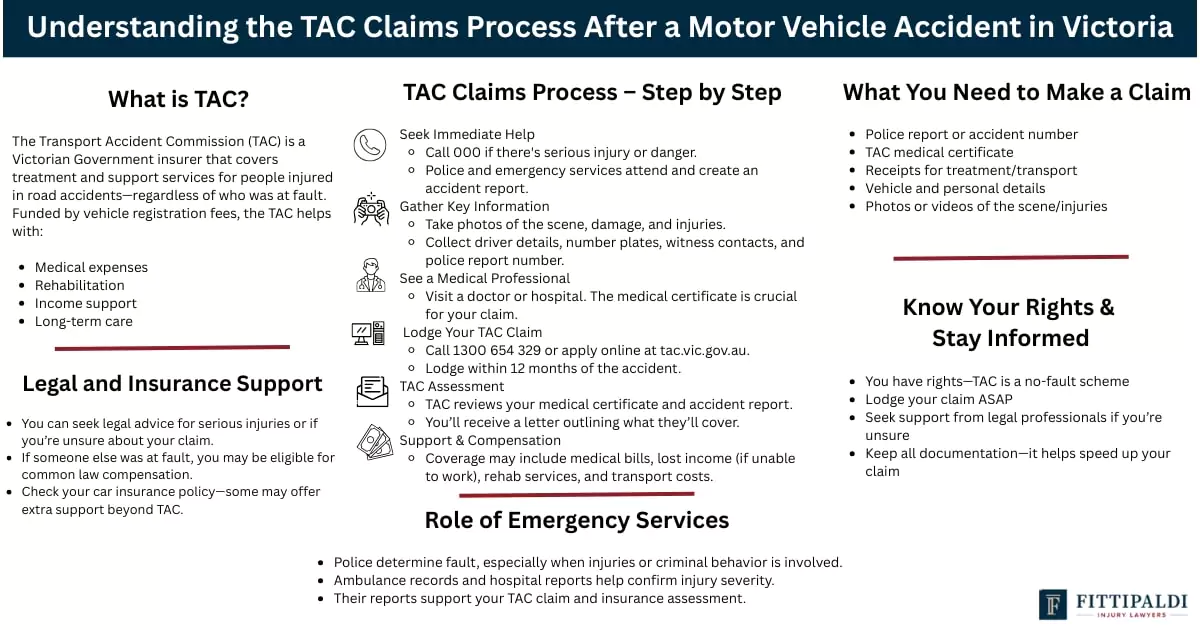

The Transport Accident Commission (TAC) is Victoria’s statutory insurer for all road accidents, providing compulsory third-party coverage for everyone using Victorian roads.

Whether you’re a driver, passenger, cyclist, pedestrian, or using a motorised mobility device, you are automatically covered when involved in a motor vehicle accident in Victoria.

The TAC covers medical treatment, rehabilitation, income support, and other necessary expenses related to injuries sustained in road accidents. Coverage applies regardless of fault, insurance status, or vehicle registration.

Comprehensive Coverage for All Road Users

This coverage includes drivers, passengers, motorcyclists, cyclists, pedestrians, and users of mobility devices. The TAC ensures all individuals injured in road accidents receive prompt support and assistance.

How to Access TAC Benefits

TAC benefits activate automatically after an accident and can be accessed by lodging a claim with the Commission. Early notification helps ensure timely medical treatment and financial support throughout the recovery process. You do not need to wait for the fault to be determined to access these benefits.

What TAC Benefits Cover in Melbourne Accidents

| Benefit Type | What’s Covered | Eligibility | Duration / Limit |

|---|---|---|---|

| Medical & Hospital Care | Emergency care, surgery, GP visits, private/public | All road users | No set limit if related to injury |

| Income Support | Weekly payments based on pre-injury earnings | If unable to work | Up to 3 years (or longer for severe cases) |

| Rehabilitation | Physio, OT, speech therapy, psychology | If medically required | As long as needed |

| Equipment / Modifications | Mobility aids, home/vehicle modifications | For severe injuries | Assessed case by case |

| Home & Attendant Care | In-home assistance, full-time care | Significant impairment | Ongoing as required |

| Lump Sum Compensation | For permanent impairment | Must meet legal thresholds | One-off payment |

Medical and Hospital Expenses

TAC covers all medical and hospital costs related to your accident injuries, including emergency care, specialist consultations, and ongoing treatment. Ambulance services are also included at no cost, with coverage extending to both public and private healthcare providers.

Income Support

If your injuries prevent you from working, TAC provides weekly income support based on your pre-accident earnings for up to three years, with possible extensions for severe cases.

Rehabilitation and Equipment

TAC funds rehabilitation services, such as physiotherapy, and necessary equipment, including mobility aids, home modifications, and vehicle modifications. Travel expenses for medical appointments are also reimbursed.

Home and Attendant Care

For severe injuries, TAC offers home and attendant care services to assist with daily activities, helping you maintain your independence.

Lump Sum Compensation

If your injury causes permanent impairment meeting statutory thresholds, TAC provides lump sum compensation to acknowledge long-term impacts after medical recovery.

Your Rights Regarding Property Damage and Vehicle Repairs

Claiming Repair Costs from the At-Fault Driver

While TAC handles personal injuries, property damage claims follow standard insurance procedures. If another driver caused the accident, you can claim repair costs from their insurance. This covers damage to your vehicle and any personal property affected.

If the at-fault driver has comprehensive insurance, their insurer should cover the repairs without requiring you to pay an excess. Subject to the terms of the policy, the insurance company should assess the damage and either fix your vehicle or, if it’s a total loss, pay you the market value to replace it.

Common Law Rights for Pain and Suffering & Economic Loss

| Criteria | TAC Claim | Common Law Claim |

|---|---|---|

| Do you need to prove fault? | ❌ No — benefits apply regardless of who caused the accident | ✅ Yes — you must prove another party was negligent |

| What’s covered? | Medical care, income support, rehab, some lump sum if impaired | Pain and suffering, future loss of earnings, economic damages |

| Injury severity requirement? | Any injury that needs treatment | Must meet the legal definition of a “serious injury” |

| Time limit to claim? | No strict cut-off, but early notice recommended | Strict 6-year deadline from accident date |

| Legal help required? | Optional (recommended for complex cases) | Essential — legal process is more involved |

| How long does it take? | Usually faster – focus is on immediate support | Slower – involves investigation and potentially court |

| Can you claim both? | ✅ Yes | ✅ Yes (often done simultaneously with legal guidance) |

| Who pays? | TAC (funded via vehicle rego fees) | At-fault party’s insurer (or the party themselves) |

Common Law Damages

In Victoria, you have the right to seek common law damages for pain and suffering, loss of enjoyment, and financial losses that go beyond what TAC covers.

To do this, you’ll need to prove that another party—usually the other driver—was negligent, and your injury meets the legal threshold for being serious.

Common law claims can help you get compensation for things TAC doesn’t fully cover, like ongoing pain or economic losses that exceed TAC’s limits. But keep in mind, these claims can be complex, and you’ll want expert legal help to navigate the process smoothly.

What Counts as a “Serious Injury”?

To make a common law claim, your injury must meet Victoria’s “serious injury” standard. This means that medical professionals will assess your condition, and the law will examine how your injury affects your life and future.

This threshold is set quite high on purpose to balance who can claim and keep the system sustainable. Your medical reports and treatment records will be key in showing whether your injury qualifies.

Don’t Miss the Deadline

You generally have six years from the date of your accident to start a common law claim.

Courts might grant exceptions in rare cases, but it’s best not to wait.

Unlike TAC claims, which are more flexible, this deadline is strict.

Getting legal advice early can protect your right to claim and help you avoid missing out on compensation, especially if your injuries have long-term effects.

You Can Pursue TAC and Common Law Claims Together

Many people claim TAC benefits and pursue common law damages simultaneously, as they cover different aspects.

TAC provides immediate support and ongoing care, while common law claims can offer additional compensation for pain and suffering.

Managing both claims together can be tricky, but with the proper legal guidance, you can make sure one doesn’t hurt the other. Personal injury lawyers know how to handle this balance and will help you through every step.

Legal Representation and No Win No Fee Options

Free Initial Consultations

In Melbourne, you can easily access free initial consultations with specialist personal injury lawyers.

These meetings help you understand your options, see how strong your claim might be, and decide on the best legal support—all without any upfront costs.

During these consultations, lawyers will review your TAC entitlements and any potential common law claims, giving you clear advice tailored to your situation.

Having this free legal guidance early on levels the playing field between you and the big insurance companies.

No Win No Fee Arrangements

Many trusted personal injury law firms in Melbourne offer no-win, no-fee arrangements. This means you don’t pay any legal fees unless your case is successful. It alleviates financial worries and makes quality legal support accessible, particularly for common law claims where upfront costs can be a significant barrier.

Under this setup, the lawyer’s fees come from your settlement or court award, not from your pocket. This way, your lawyer is motivated to work hard for the best possible outcome.

Your Right to Change Lawyers

If you ever feel your current lawyer isn’t the right fit, you have the right to switch to someone else at any point during your claim. You’re never stuck with inadequate representation.

Changing lawyers involves transferring your files and possibly adjusting fee arrangements, but it won’t harm your claim. Knowing this gives you control to find legal help that suits your needs and communication style.

For more information on how to choose the right car accident lawyer, check our latest blog.

Special Circumstances and Additional Rights

When the At-Fault Driver is Uninsured or Unknown

Even if the person responsible for your accident lacks insurance or cannot be located—such as in hit-and-run situations—your TAC coverage still ensures you receive injury compensation.

This means you don’t need to worry about the other driver’s insurance status or whereabouts when it comes to your injury benefits.

However, for property damage caused by an uninsured driver, you may need to claim through your own comprehensive insurance or consider pursuing legal action against the driver personally.

Rest assured, these issues do not affect the injury support provided by TAC.

What About Passengers, Cyclists, and Motorcyclists?

If you’re a passenger, your TAC rights are just as strong as the driver’s—no matter who you were riding with or whether you played a part in the accident.

This includes passengers in taxis, rideshares, or private cars. Your status as a passenger doesn’t reduce your entitlements.

For cyclists and motorcyclists, TAC offers complete protection when you’re involved in an accident with a motor vehicle.

This applies whether you were cycling on the road or riding a motorcycle. In some cases, TAC even covers damage to your protective gear.

Accidents on Public Transport

If you’ve been injured on public transport, such as trams, trains, or buses, TAC usually covers your injury compensation.

Property damage claims might work differently depending on the transport operator, though.

For example, Metro trains may have separate rules around property damage.

Determining which system applies to your accident can be challenging, so seeking legal advice is a wise move to understand your rights and options.

What if the Accident Happened on Private Property?

If your accident occurred in a shopping centre car park, TAC may not cover property damage, but injury compensation is usually still applicable.

The line between public roads and private property can become blurry, especially in areas like car parks that serve as de facto roads.

Because this can become complicated, it’s best to seek legal advice early on to determine which rules apply to your situation.

Interstate Visitors Are Also Protected

If you’re visiting Victoria from another state and get injured here, TAC will cover your injury compensation just like it does for locals.

However, when it comes to property damage claims, you might need to look at your home state’s laws or your insurance policies.

Victoria wants to ensure that everyone on its roads is protected, regardless of their origin. So if you’re an interstate visitor, it’s important to understand both your TAC rights here and how your home insurance might come into play.

Time Limits and Important Deadlines for Melbourne Accident Claims

TAC Claim Notification Requirements

It’s best to lodge your TAC claim as soon as you can after an accident. The scheme focuses on early support, so while the deadlines aren’t as strict as they are for common law claims, notifying TAC early helps them get you the assistance you need without delay.

By contacting TAC promptly, you also help ensure your accident and injuries are accurately documented while everything is still fresh in your mind. Even if you’re late notifying TAC, it doesn’t automatically mean you’ll miss out on benefits—but the sooner you reach out, the better your access to support and services.

Keep an Eye on the Six-Year Limit for Common Law Claims

If you want to pursue common law damages, remember there’s a firm three-year deadline from the date of your accident.

Courts rarely grant extensions, and this clock starts ticking from when the accident happened, not when you fully realise your injuries.

Because proving serious injury and negligence can be complicated, it’s important to start your legal process well before that deadline.

Waiting too long can hurt your claim’s strength and leave you scrambling to gather evidence and expert opinions.

Why You Should Get Legal Advice Early

Getting legal advice early can make a big difference. It keeps all your options open while evidence is available and witness memories are fresh. Waiting too long can limit your strategies and make it harder to meet procedural requirements.

Many people hesitate, hoping things will sort themselves out or worrying about legal costs.

However, early advice often reveals important issues and opportunities that become increasingly difficult to address as time passes. In the long run, it can save you time, stress, and money.

Getting Help: Free Resources and Support Services

Free Legal Advice Clinics

Melbourne hosts numerous free legal advice clinics specialising in personal injury and TAC claims, providing accessible assistance regardless of financial means. Organisations such as Victoria Legal Aid offer comprehensive free legal support, helping accident victims understand their rights and navigate the claims process.

Many clinics offer initial advice and can help you determine whether you require ongoing legal representation. They serve as valuable first steps in understanding your rights and options, particularly if you’re unsure whether your situation warrants professional legal assistance.

TAC Customer Service and Support Programs

The TAC operates comprehensive customer service systems, including online tools for claim assessment, progress tracking, and benefit information.

Their customer service representatives can explain your entitlements and guide you through the claims process, providing valuable assistance from government specialists.

TAC’s online resources include eligibility checkers and claim status tools that help you understand your benefits and track progress.

These tools provide transparency about your claim and help you stay informed about available services and support.

Community Legal Centres and University Clinics

Community legal centres throughout Melbourne provide free legal advice, often with specialists in personal injury law. University-affiliated legal clinics provide services under the supervision of experienced lawyers, offering high-quality advice while training the next generation of legal professionals.

These centres serve diverse communities and often provide culturally sensitive services for non-English speaking clients. They represent important community resources that help ensure legal advice is accessible to all Melbourne residents regardless of economic circumstances.

Support Groups and Financial Counselling

Support groups for accident victims and their families operate throughout the Melbourne area, offering peer support and practical advice from others who understand the challenges of recovery from an accident.

These groups provide emotional support and valuable tips that complement professional medical and legal services.

Financial counselling services assist individuals struggling with accident-related costs, providing guidance on managing expenses during recovery periods when income may be reduced.

These services recognise the intersection between accident compensation and personal financial management, offering specialised advice for accident victims.

Protecting Your Rights: Essential Action Steps

Understanding your rights after a car accident in Melbourne is just the beginning—protecting those rights means taking quick, informed action. Victoria’s system can be complex, with TAC benefits, insurance claims, and common law rights all overlapping.

That’s why making mistakes early on can affect your recovery and compensation down the road.

The best thing you can do is get legal advice early from specialists who know how these systems work together. While TAC offers great immediate support, getting the most out of your claim often means juggling multiple claims at once without risking any of them.

Remember, your rights don’t depend on fault, insurance, or even citizenship—Victoria’s system is here to support everyone involved in road accidents.

However, to make the most of those rights, you need to understand how they all fit together and obtain the right professional help to guide you through the process.

If you’ve been in a car accident in Melbourne, don’t wait to learn about what to do after a car crash.

Reach out to one of our experienced car accident lawyers at Fittipaldi Injury Lawyers, and let our expert team handle the complexities so you can focus on healing and moving forward with confidence.

Frequently Asked Questions

What's the first step you should take right after a car accident?

Stop immediately and ensure everyone’s safety. Call emergency services if needed. Do not leave the scene. Notify police to attend for an official report, which is essential for insurance and fault determination. Collect witness details, take photos of the scene, and exchange contact and insurance information with other drivers. In Victoria, the police must be notified of a motor vehicle accident for a personal injury claim to be lodged.

Will insurance pay if it wasn’t my fault?

Yes. The at-fault driver’s insurance covers your repair and property damage costs. In Victoria, the compulsory third-party (CTP) insurer is responsible for handling injury compensation. Your insurer may waive your excess if the other party is identified and liable. Notify your insurer promptly with complete documentation.

How much do car accident settlements usually pay?

Settlements vary depending on the severity of the injury, the extent of property damage, lost wages, and the pain and suffering experienced. Minor accidents yield smaller payouts; serious injuries and common law claims can result in higher compensation.

How does car insurance work if I’m at fault in Australia?

Your insurance covers the other party’s repair and property damage costs per your policy. You may pay an excess. Your insurer manages claims and negotiations. Being at fault can increase premiums. Understand your policy and seek legal advice if needed.